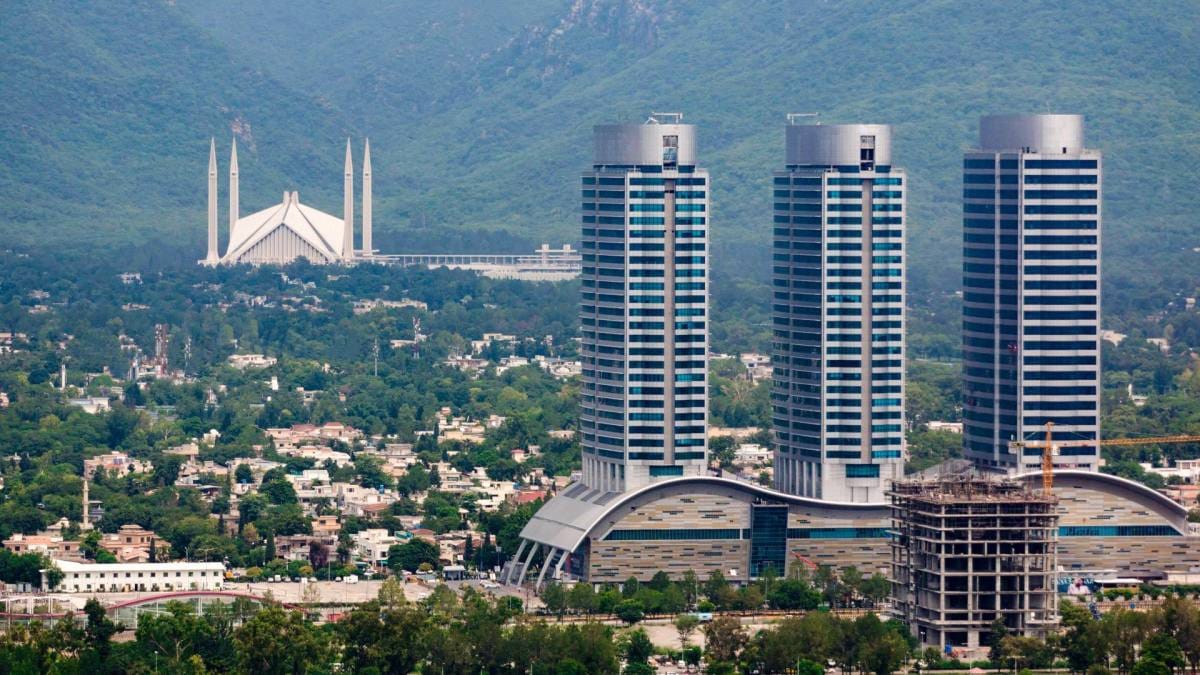

IMF Approves $7 Billion Loan for Pakistan Amid Economic Struggles

The approval comes after months of negotiations and two months following a staff-level agreement between the IMF and Pakistani authorities

The International Monetary Fund (IMF) has approved a crucial $7 billion loan package for Pakistan to help stabilize its ailing economy, as announced on Wednesday. The loan will be disbursed in installments over a 37-month period, with an immediate release of $1 billion, offering some relief to the cash-strapped South Asian nation.

Prime Minister Shehbaz Sharif hailed the approval, expressing gratitude to IMF Managing Director Kristalina Georgieva and her team for their support. Sharif, in a statement, acknowledged the critical role China and other allied countries played in securing the deal, emphasizing the “tremendous support” from nations such as Saudi Arabia and the UAE.

The IMF praised Pakistan’s recent efforts to stabilize its economy. “Growth has rebounded, inflation has fallen to single digits, and foreign exchange markets have calmed, allowing for the rebuilding of reserve buffers,” the IMF noted. However, the global lender warned of enduring challenges, citing structural vulnerabilities that continue to undermine the nation’s economic potential.

Long-Term Challenges Remain

While the approval of the loan is a significant step toward financial stability, the IMF highlighted several persistent issues. It criticized Pakistan's weak governance, narrow tax base, and an oversized public sector that hinders private investment. The IMF also noted that insufficient spending on health, education, and infrastructure has exacerbated poverty and left Pakistan vulnerable to external shocks, including climate change.

The approval comes after months of negotiations and two months following a staff-level agreement between the IMF and Pakistani authorities. The loan marks the 24th IMF program for Pakistan since 1958, underscoring the nation’s long-standing reliance on external assistance to meet its economic needs.

A History of Debt

With a total debt exceeding $250 billion, accounting for 74% of its GDP, Pakistan has struggled with overlapping political and economic crises in recent years. Last year, it narrowly avoided default after receiving emergency funds from friendly nations and a previous IMF bailout. Approximately 40% of Pakistan’s debt is owed to external creditors, with China being the largest single foreign creditor.

Economists in Pakistan have expressed mixed reactions to the new loan. Kaiser Bengali, a prominent Pakistani economist, told AFP, “This deal will help us pay back our immediate debts, but nothing more than that.” He emphasized the need for structural reforms, beyond increasing taxes, to address the nation’s chronic economic challenges.

The Path Ahead

Pakistan's finance minister, Muhammad Aurangzeb, acknowledged the "transitional pain" the nation will endure as it implements the IMF’s reforms. These reforms include increasing tax collection, cutting power subsidies, and addressing the inefficiencies in the country’s energy sector—an ongoing challenge that has kept millions of citizens burdened by high household bills.

While the loan provides Pakistan with much-needed breathing room, the IMF has made it clear that fundamental reforms are essential for long-term economic stability. As Pakistan moves forward, the focus will be on building a stronger, more resilient economy that can withstand both internal and external pressures.

Prime Minister Sharif has expressed optimism that this IMF package could be Pakistan's last, emphasizing that the country must now work toward financial independence and break the cycle of recurring bailouts.

For the people of Pakistan, the immediate concern remains whether these efforts will be enough to ease their economic hardships as inflation continues to take a toll on everyday life.

We also wrote