Global Stock Market Sell-Off Intensifies: Dow Plunges 800 Points, Nasdaq and S&P 500 Sink

Wall Street tumbled on Monday as economic concerns triggered a major sell-off. The Dow Jones Industrial Average (^DJI) dropped nearly 800 points.

Wall Street faced a significant downturn on Monday as mounting concerns over the health of the US economy led to a major sell-off. The Dow Jones Industrial Average (^DJI) plummeted nearly 800 points, marking a substantial decline. The Nasdaq Composite (^IXIC) dropped almost 3%, following a correction triggered by Friday's sharp losses. Meanwhile, the S&P 500 (^GSPC) cascaded down more than 2%.

The CBOE Volatility Index (^VIX), known as Wall Street's "fear gauge," soared to its highest level since the early days of the COVID-19 pandemic in March 2020. Treasury yields also took a hit, with the benchmark 10-year Treasury yield (^TNX) falling below 3.8%.

The global stock market's sell-off accelerated after a lackluster US jobs report on Friday heightened fears about the economy and raised doubts about whether the Federal Reserve had delayed cutting interest rates for too long. The CME FedWatch tool indicated that nearly 100% of bets are on the central bank to cut rates by 0.5% by its September meeting.

Major companies bore the brunt of the sell-off at the market's open. Apple (AAPL) saw a 4% decline, exacerbated by news that Berkshire Hathaway (BRK-B) had halved its stake in the tech giant. Nvidia (NVDA) experienced a continued pullback, dropping as much as 13% before regaining some ground. Tesla (TSLA) fell more than 3%.

The cryptocurrency market also suffered, with Bitcoin (BTC-USD) sinking over 8%, nearing the $54,000 level.

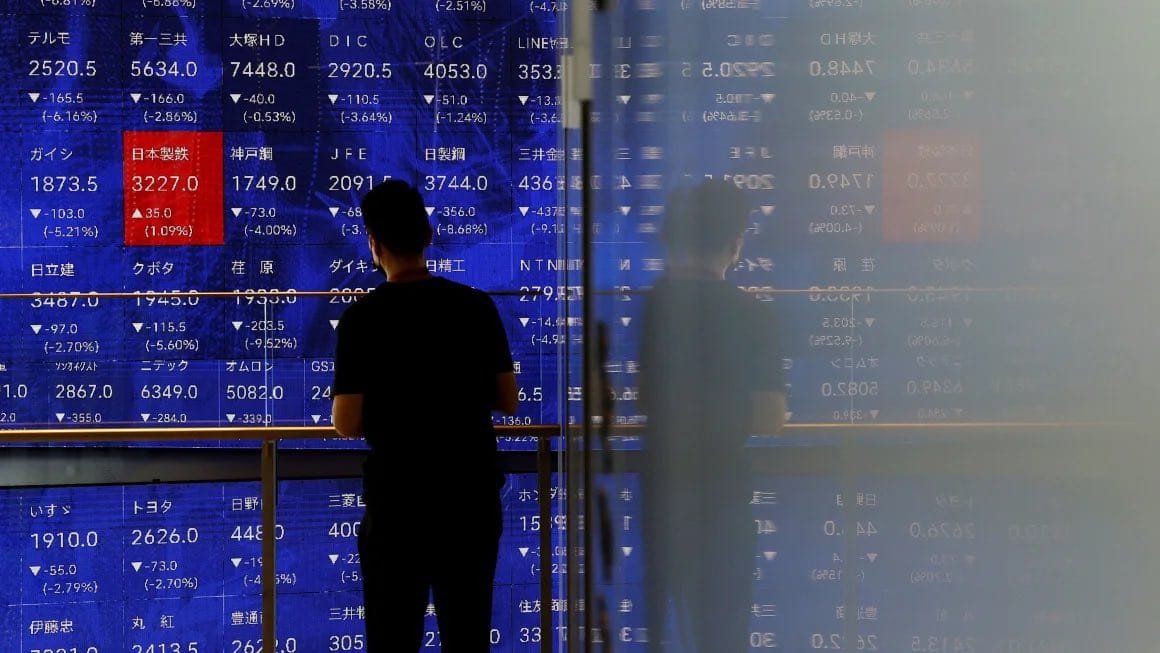

The ripple effects of the sell-off extended globally. Asian markets started the week with similar declines, highlighted by Japan's Nikkei 225 (^N225), which endured its biggest-ever daily loss of more than 12%. This dramatic drop followed a surprise interest rate hike by the Bank of Japan last week. The sharp appreciation of the Japanese yen against the US dollar has spurred heavy selling, as speculators liquidated their holdings of US risk assets previously purchased with borrowed money at Japan's prior 0% interest rate.

In Japan, the Nikkei 225 index plummeted 4,451 points on Monday, its largest point drop in history. This 12% drop marked the index's worst one-day fall since October 1987. The decline pushed the Nikkei’s losses since early July to 25%, driving it into bear market territory.

Neil Newman, head of strategy at Astris Advisory in Tokyo, described the event as a crash reminiscent of “Black Monday” in October 1987, when global markets plunged, and the Nikkei lost 3,836 points.

The anticipation of a sharp slowdown in the US economy has heightened expectations for the Federal Reserve to slash interest rates. Concurrently, the Bank of Japan's interest rate hikes to curb inflation have boosted the yen's value against the US dollar, making Japanese export-dependent stocks less attractive.

The US market faces a quieter week of data and earnings, with weekly unemployment claims due on Thursday expected to draw more attention than usual.